Planning for retirement can feel overwhelming, especially when trying to figure out how much to save. One of the most important steps is calculating how much you need to comfortably retire and sustain your desired lifestyle. This is where our Retirement Savings Calculator comes in, offering an intuitive way to estimate your savings goals based on key factors such as initial savings, monthly contributions, years until retirement, and anticipated withdrawals during retirement.

Try our tool here

https://www.plainsavings.co.uk/retirement-calculator/

Understanding the Basics of Retirement Saving

- Initial Investment: This refers to the amount you already have saved towards your retirement. The more you’ve set aside initially, the less pressure there is on your future contributions. If you’re starting with no savings, don’t worry — there’s still time to build a substantial retirement fund by focusing on monthly savings and investment growth.

- Monthly Savings: Consistency is key. Regular contributions, even if they start small, grow significantly over time thanks to compound interest. Our calculator allows you to adjust the amount you set aside each month, helping you to see how small changes can greatly impact your total savings at retirement.

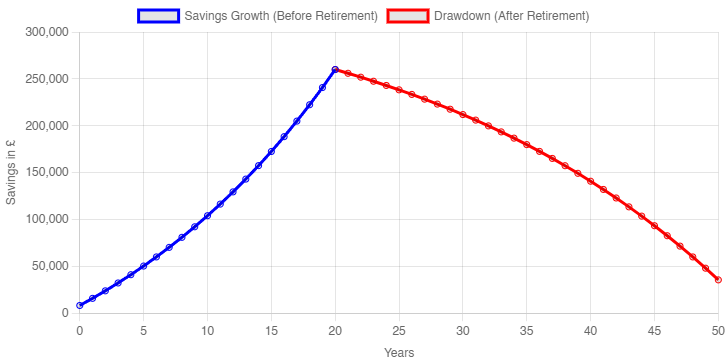

- Growth Rate During Savings: This represents how much your investments grow annually before you retire. Even a modest annual growth rate can help boost your savings. For example, with a growth rate of 5%, your investments are working for you every year, increasing your total savings.

- Years Until Retirement: The longer you have before retirement, the more time your investments have to grow. If you’re early in your career, even small monthly contributions can grow significantly over 20 or 30 years.

How Much Will You Need in Retirement?

A key part of planning is estimating how much you’ll need to withdraw during retirement to maintain your standard of living. This includes covering your essential expenses such as housing, food, and healthcare, but also ensuring you can enjoy your retirement, whether through travel, hobbies, or spending time with family.

Our tool also factors in monthly withdrawals during retirement. You can set how much income you’ll need each month and adjust it to reflect inflation. If you select the index withdrawals option, the calculator will estimate how much you’ll need in future years to ensure your income today is worth the same in retirement.

Indexing for Inflation

Inflation reduces the purchasing power of your money over time. What seems like a comfortable monthly income today may not be enough in 20 or 30 years. By indexing withdrawals for inflation, the tool adjusts your retirement income to reflect its future value. This ensures that if you plan to withdraw £2,000 a month today, that amount will maintain its purchasing power at retirement.

Using the Fix Shortfall Feature

Sometimes, your initial savings and contributions may not be enough to meet your desired length of retirement income. Our calculator offers a Fix Shortfall option to help find the best solution. It will calculate whether you need to:

- Increase your monthly savings

- Reduce your desired monthly withdrawal in retirement

You can even lock specific variables to reflect non-negotiable goals, such as a fixed retirement date or income target, allowing the tool to find the best solution using the remaining adjustable factors.

Plan for a Secure Retirement

The earlier you start saving and planning, the better off you’ll be. Our Retirement Savings Calculator offers a clear way to explore your options and make adjustments that can help you achieve your retirement goals. With its ability to account for growth rates, inflation, and varying income needs, the tool provides a realistic view of what it will take to maintain your lifestyle in retirement.

Disclaimer

This article and the Retirement Savings Calculator are designed for informational purposes only and do not constitute financial advice. For personalised financial advice, please consult Plain Savings.